Accounts Payable: Definition, Example, Journal Entry

All supplier invoices are immediately routed to the payables department as soon as they are received. This can be a difficult processing step, since invoices might have been sent to the person authorizing a purchase, or perhaps to a subsidiary. In either case, there must be a firm requirement for the recipient to immediately forward the invoice to the payables department. A particular concern is when invoices are sent to people who no longer work for the company – perhaps by email; if so, it may take repeated inquiries from the supplier before the invoice is found. Accounts payable most commonly operates as a credit balance because it is money owed to suppliers.

How to Calculate Accounts Payable in Financial Modeling

However, delaying free lawn care invoice template payments for too a long of a period would critically impact Walmart’s relationship with its suppliers. On the other hand, if your business is considered as taking advantage of discounts on early payments if it is paying its suppliers quickly. For example, the ‘Accounts Payable Aging Summary’ report, not only tells you about the vendors that you owe money to, but it also highlights the invoices against which payments are overdue.

Further, it also ensures proper invoice tracking and avoiding duplicate payment. The reverse of accounts payable is accounts receivable, which are short-term obligations payable to the net method of recording accounts payable a company by its customers. Another difference is that accounts payable is classified as a short-term liability, while accounts receivable is classified as a short-term asset.

Automation ensures that data is accurately captured and processed, minimizing mistakes that can occur with manual handling. This leads to more reliable financial records and fewer discrepancies to resolve. The owner or someone else with financial responsibility, like the CFO), approves the PO. Purchase orders help a business control spending and keep management in the loop of outgoing cash. As a result, there will be no need for you to manually enter or upload all your invoices, and your purchase and payment process would also get automated. Delaying the payments for a few days would help Walmart Inc to hold more cash to eventually pay to its suppliers.

Example of Accounts Payable Turnover Ratio

By this point, you probably know that implementing an accurate accounts payable process is key to keeping your finances in check and making sure payments don’t go missing. But it’s no lie that it can be a time-consuming process that needs streamlining. Wave Accounting offers free what changes in working capital impact cash flow accounting software with accounts payable features like invoice tracking, bill payment and automatic reminders.

In addition to this, Robert Johnson Pvt Ltd made purchases worth $6,000,000 during the year. In order to figure out the accounts payable turnover ratio, you’ll first need to calculate the total purchases made from your suppliers. These purchases are made during the period for which you need to measure the accounts payable turnover ratio. Some people mistakenly believe that accounts payable refer to the routine expenses of a company’s core operations, however, that is an incorrect interpretation of the term. Expenses are found on the firm’s income statement, while payables are booked as a liability on the balance sheet.

Recording Accounts Payable

These billed amounts, if paid on credit, are entered in the accounts payable module of a company’s accounting software, after which they appear in the accounts payable aging report until they are paid. Any amounts owed to suppliers that are immediately paid in cash are not considered to be trade payables, since they are no longer a liability. Non-trade payables, such as accrued expenses, dividends payable, or wages payable, are recorded in other accounts in order to more easily identify them. There are multiple ways to improve the operation of an accounts payable process. One is to require all new suppliers to fill out a Form W-9 before they are initially paid.

Zoho Books lets you create purchase orders, pay bills, and manage vendor information. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- As explained earlier, not all the money owed by a company to creditors is eligible for AP entry.

- Below we’ll define accounts payable and how to set up an effective process for accounts payable management.

- This kind of list can be developed considering certain factors, including the supplier’s performance, their financial soundness, brand identity, and their capacity to negotiate.

- Typical payables items include supplier invoices, legal fees, contractor payments, and so on.

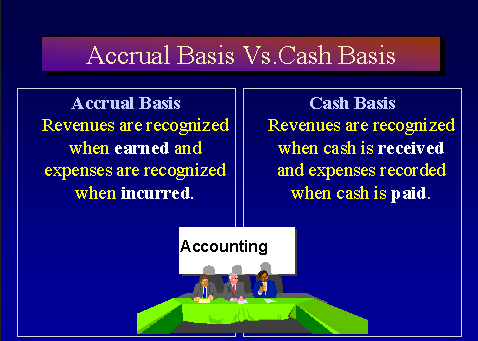

Even if you only have a few vendor payments due, consider setting up a regular payment schedule. It simply makes it easier to pay invoices on time and avoid overdue bills. A purchase order is a document sent to a vendor or supplier to request goods or services. It includes details such as the quantity of items, the price, and the delivery date. In this article, we’ll break down the accounts payable process step-by-step and offer some solutions to help streamline your workload. Under the accrual method of accounting, an invoice or purchase order is recorded when it is presented by the creditor (as opposed to when it is paid).